No credit check heloc

Find answers to. A HELOC can also affect your credit scorepositively or negativelydepending on how you manage the account.

Heloc Home Equity Line Of Credit Lgfcu

6 No or low closing cost for new HELOC loan only.

. Get unsecured in as little as 4 months. No minimum California draw. Guaranteed loans with no credit check do exist.

Of the six lenders reviewed in this article two are good prospects for a short-term cash advance with no hard credit check. Home Equity Line of Credit. Consult your tax adviser for further information regarding the deductibility of interest and charges.

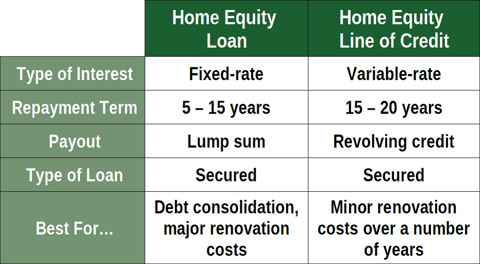

Home equity loans usually arent the answer if you only need a small infusion of cash. With a HELOC you are free to borrow and repay on your schedule while you can only borrow a fixed lump-sum from a second mortgage and have to make payments for the second mortgage on a fixed schedule. No annual fee no foreign transaction fees no minimum security deposit.

You will also need a good credit history credit score of 620 or higher and a debt-to-income DTI ratio in the low 40s or lower. No minimum Arizona draw. Your score could benefit if you make timely payments and keep the amount you borrow from your HELOC relatively low but falling behind on your payments could mean bad news for your credit score and overall financial health.

Minimum payment for master line of credit is calculated at the time a credit advance is made using a payoff period of 180 monthly payments or 150 minimum payment whichever is. No credit check or US. For the HELOC the Rate is subject to a minimum of 399 and the maximum APR Line of credit has a 10-year draw period with a maximum of 15-year repayment period.

Supercharge your savings at 329 APY. For instance if you have a HELOC for 10000 and close the account after it is paid off that means the 10000 of available credit is no longer being factored into your credit score. A HELOC is similar to a home equity loan in terms of working alongside your existing first mortgage but it acts more like a credit card with a draw period and a repayment period and is one of the more popular options with todays homeowners.

Our regular HELOC has a fixed rate for the first 12 months then a variable rate for the rest of the term. 1 maximum Combined Loan-to-Value CLTV of 75 2 borrower must take an initial draw of 25000 and maintain this balance for 12 months 3 borrower must have automatic transfers from a Bethpage personal savings or checking. If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40.

Appraisal fee and title insurance if required is an additional charge. Personal loans with no credit check up to 35000 Opting for loans has never been easier FundsJoy provides easy no-credit check loans even for people with bad credit scores. Health Savings Account HSA IRAs and Education Savings Accounts.

HELOC is a line of credit secured by equity you have in. Receive assistance from our customer support center. Though some lenders will extend loans for 10000 many wont give you one for less than 35000.

Mission Fed is proud to offer benefits such as lower interest rates and fewer fees on Home Equity Lines of Credit to help you keep your costs down. To qualify for a HELOC youll need to have more than 15 20 equity in your home at its current appraisal value. No minimum Florida draw.

Obtaining the best rate also requires the following criteria to be met. 2 The minimum Comerica Home Equity FlexLine draw by check is. The charge for an appraisal is typically 430-585 the charge for title insurance is typically 375.

Should not be. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. Say you have a home currently worth 300000 with a balance of 200000 on your first mortgage and your lender will allow you to access up to 85 of your homes value.

When you get a HELOC through Prosper your mortgage and HELOC combined can be worth as much as 90 of your homes fair market value. Check my rate Learn more If you are a service member on active duty prior to seeking a refinance of your existing mortgage loan please consult with your legal advisor regarding the relief you may be eligible for under the Servicemembers Civil Relief Act or applicable state law. No minimum Texas draw.

You can access a loan for up to 2000 at an interest rate that depends on your credit scoreRepayment must be complete in 12 months. 7 free and low-cost cash advance apps 1. Includes a 025 discount for automatic payments from a Union Bank account.

Certificate of Deposit CD Accounts. Search SCCU - Personal Homepage. No check-writing or HELOC account management fees.

Credit history from day 1 at major credit bureaus get 25 when you build your credit score to a 700 credit score within 12 months of use. After the initial 7-year initial fixed-rate period and on lines of credit of 250000 to 2000000. 1 All loans are subject to credit approval.

Check the report thoroughly to make sure there are no errors that are hurting your score its smart to do this every year anyway. But the guarantee is really an assurance that the lender will do everything possible to get you a loan notwithstanding your low credit score. 1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account set up with automatic monthly payment deduction at the time of origination 5 A loan-to-value LTV of 80 or less 85 or less in Michigan.

Based on rates as of 09062022 842 AM PT. Special 21-Month CD 1. Personal Home Equity Solutions Home Equity Line of Credit HELOC.

If you want a low HELOC rate Credit Union HELOC rates from Mission Fed can help. There also is a one time 50 fee due at closing for refinancing an existing Summit Credit Union HELOCs. To obtain an introductory rate borrower must meet credit and loan program requirements including but not limited to.

No SSN required for non-US citizens. The differences between the HELOC as a line of credit and the second mortgage as a loan still apply. The third largest credit union in Florida with over 60 locations offering home loans auto loans mortgage refinancing online banking mobile banking and more.

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

What Is A Home Equity Line Of Credit Heloc And How Does It Work

Home Equity Line Of Credit Heloc Rocket Mortgage

What Can Your Heloc Home Equity Line Of Credit Do For You

Home Equity Line Of Credit Heloc Rocket Mortgage

Pin On Home And Mortgage

Get Started On Your Mortgage Free Journey By Finding Out If Heloc Is Right For You Download Our Fr Mortgage Payment Calculator Line Of Credit Mortgage Payment

15 Frequently Asked Questions About Home Equity Line Of Credits Home Equity Line Of Credit Heloc

Essential Differences Between Home Equity Loans And Helocs Cccu

Best Home Equity Line Of Credit Heloc Lenders Of 2022 Credible

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Home Equity Line Of Credit Heloc Rocket Mortgage

Let Your Equity Work For You Visionbank

Tis The Season To Start Your Own Holiday Traditions Check Out Our No Closing Costs Special For A Limited Time Home Equity Home Equity Loan Line Of Credit

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Loans Vs Home Equity Lines Of Credit Mid Hudson Valley Federal Credit Union

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet